Today's world faces many new, emerging, and more established eWallets. Those looking at it with fresh eyes may wonder from where WeChat Pay (or Weixin Pay) suddenly appeared. Like many new financial technologies, this China-led eWallet is making global strides.

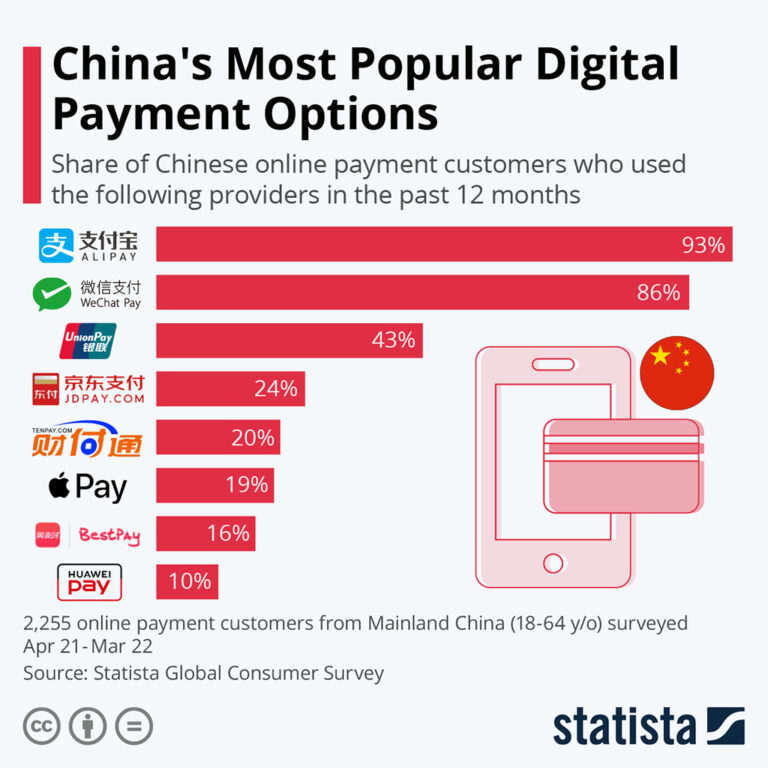

China’s uptake of digital payments is the highest in the cumulated transaction value of around $3,851 billion in 2023. Thanks to the market’s top two digital payment platforms in China, one of them is WeChat Pay. However, do you know what WeChat Pay is and if it's safe to use?

What is WeChat Pay?

Owned by the Chinese tech giant Tencent, WeChat Pay is a mobile payment and digital wallet service integrated into the WeChat app (akin to Whatsapp). Like Apple Pay and Google Pay, WeChat Pay facilitates payments with mobile devices, removing the need to carry cash around.

Today, it is among China's top digital payment providers. The service amassed approximately 900 million active users in 2021, with over 10 million merchants in 2022. WeChat Pay aims to help Chinese citizens domestically and abroad.

Although the service looks to grow internationally, its emphasis is on enabling merchants to accept WeChat Pay from Chinese tourists, facilitating cross-border eCommerce on a global scale. Hence, merchants worldwide must accept WeChat Pay to tap into this vast number of Chinese tourists.

Secure Your WeChat Pay Transactions with NordVPN

NordVPN encrypts your data and helps keep you safe and anonymous online. It works on most major platforms including desktops, Android, and iOS.

Benefits of WeChat Pay

Gone are times when we needed more cash in our wallets. Due to the steep growth trajectory of cashless payments worldwide, many are migrating towards non-cash payment modes. Aside from convenience, the many security measures incorporated into such cashless payment methods have encouraged their adoption.

Meanwhile, China is one of the major driving forces in the global outbound tourism industry. Although the number of Chinese tourists has dropped significantly due to the pandemic, this number will soar soon, especially with China relaxing its restriction rules.

Merchants offer WeChat Pay to attract more customers, enhance the user buying experience, increase credibility, boost brand awareness, and reduce shopping cart abandonment. Also, when a user purchases via the service they automatically follow the merchant’s WeChat account. This increases the number of return customers. Merchants can ride on WeChat for targeted marketing campaigns to reach consumers.

You’d want to travel light and not carry cash for security purposes. Hence, many Chinese tourists prefer to use mobile payments during their travels, and if you offer WeChat Pay, chances are, they will spend more.

How WeChat Pay Works

WeChat users automatically have their WeChat Payment accounts. Each will input their payment information into the WeChat app, thus linking to their Chinese bank accounts (over 300 supported) and overseas credit cards, including Visa, MasterCard, and JCB.

Once done, the WeChat user can initiate transactions and pay bills, make peer-to-peer money transfers, and pay for items online as long as the merchants accept WeChat Pay. The transaction notification is immediate, but the actual transaction isn’t. The settlement time depends on the payment method used by the user.

For non-Chinese users, you use your Visa, Mastercard, or JCB credit card through WeChat Pay in WeChat Wallet's merchants. Then you make payments via the static barcode in the stores.

WeChat Pay Availability

Aside from China, WeChat Pay is available in the US, the UK, Australia, Hong Kong, South Africa, Japan, Canada, and other countries.

That said, only users registered in China, Hong Kong, and Malaysia automatically see the Pay feature. If you register outside of these countries, the Pay feature will only appear if you activate the WeChat Pay or Weixin Pay features.

WeChat Pay supports currencies including but not limited to USD, GBP, HKD, MYR, JPY, CAD, AUD, EUR, NZD, and KRW. Any settlement with vendors will be in the local currency. Unsupported currencies will be via the USD.

How to Use WeChat Pay and its Key Features

WeChat Pay is for in-app purchases, eCommerce, in-store shopping, leisure (dining, movie, karaoke, and more), travel, and lifestyle purposes (doctor appointments, utility bill payment, gas station payment, traffic tickets payment, and others).

The ecosystem is comprehensive enough to cater to the various payment scenarios needed by consumers. With WeChat official accounts, the payments feature optimizes the online to offline (o2o) experience, thus enhancing more professional internet solutions for physical businesses.

Several services are available:

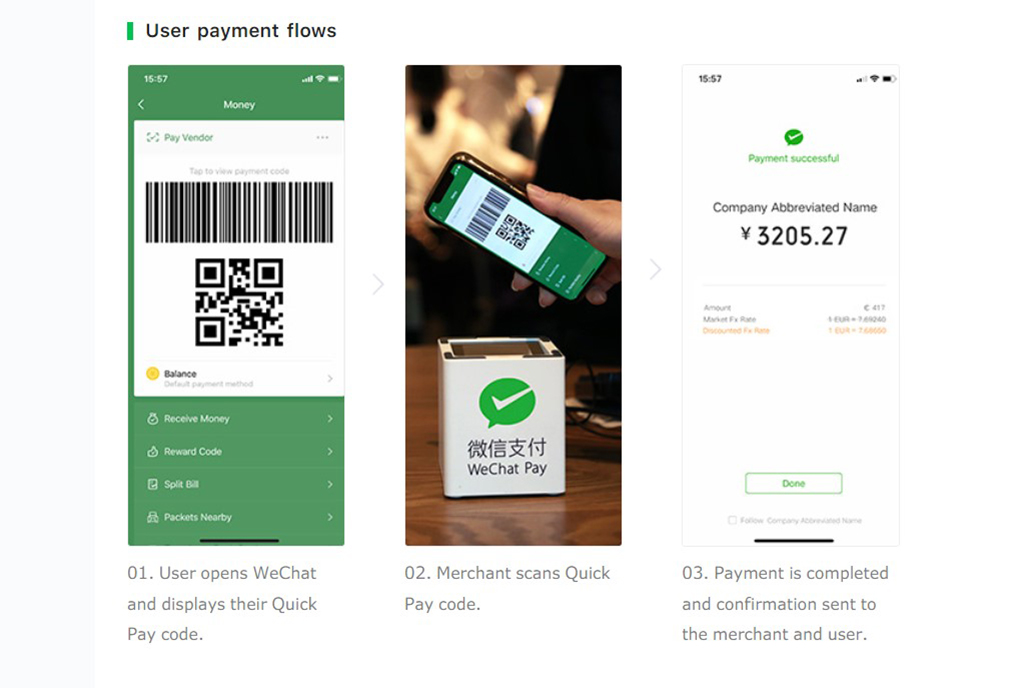

Quick Pay

Perhaps the most commonly used in-store by consumers is Quick Pay. You launch your WeChat app and pull the payment code on the WeChat Quick Pay page. The merchant scans the code to make a direct payment. Quick Pay is best suited for in-person payment in physical stores.

Payment is swift within seconds, increasing efficiency and helping to reduce human errors. This feature is available by default after the merchant signs up with WeChat Pay.

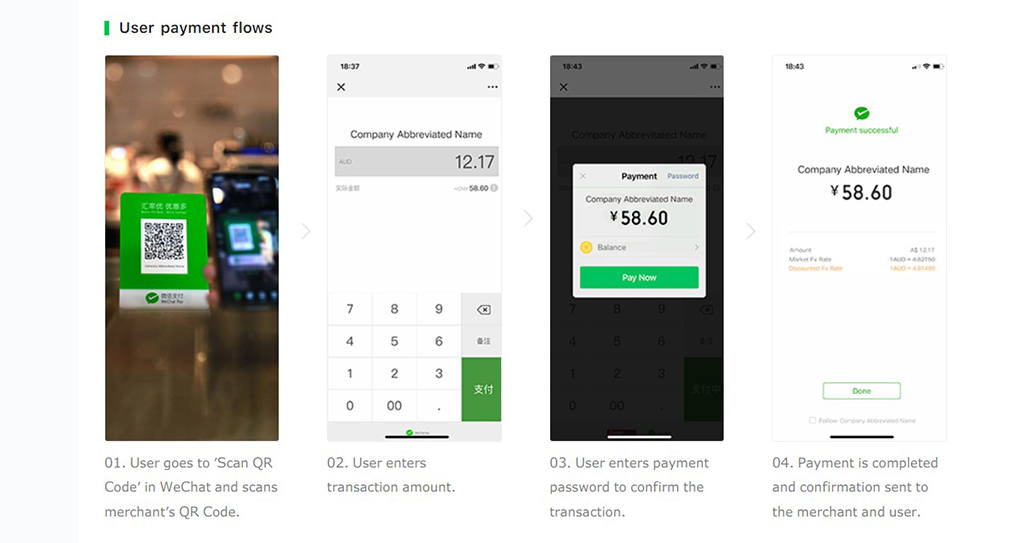

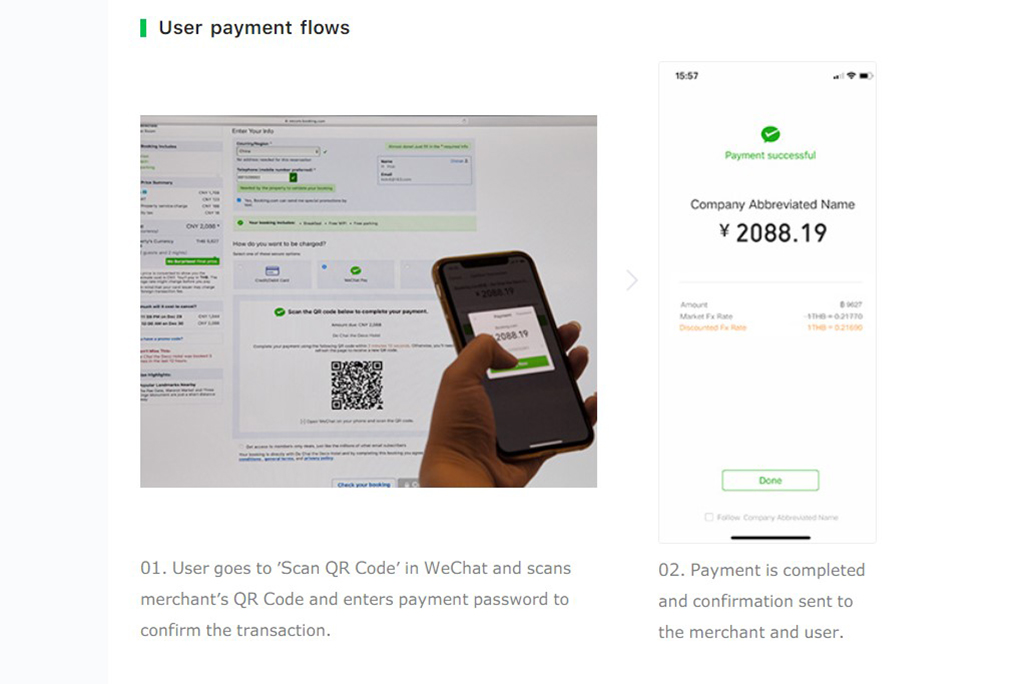

QR Code Payment

Unlike Quick Pay, QR Code Payment is the exact opposite. Merchants have their unique payment QR codes. You launch WeChat to scan the merchant's QR code and then key in the amount. After confirming the amount, you complete the payment. It is that easy.

This payment method caters to merchants with no code scanners and suits both physical and online stores. Once the merchant signs up with WeChat, this feature becomes available by default.

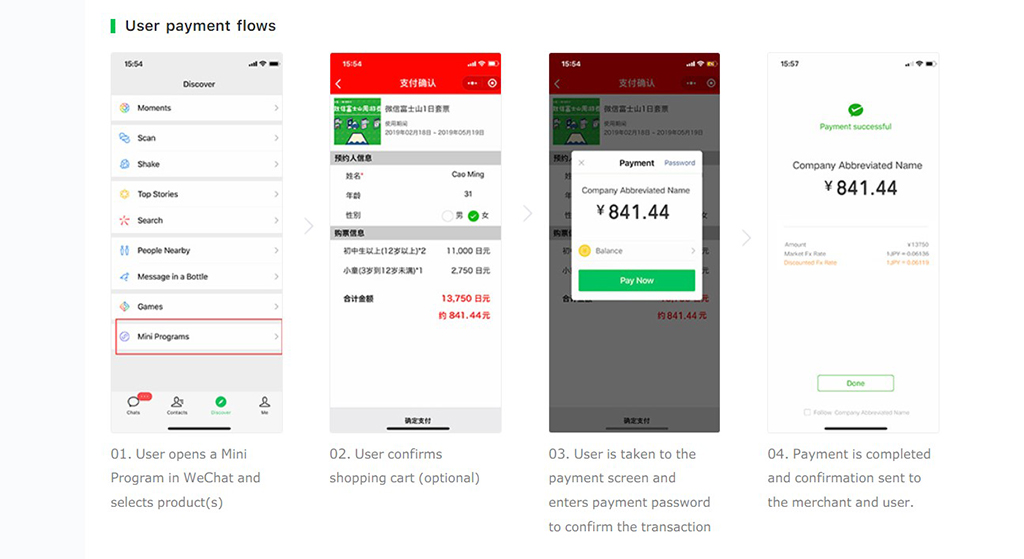

Mini Program Payment

Mini Program Payment is a feature introduced to encourage consumers to move to online purchases. Merchants’ reach will increase beyond the shores, breaking down geographical barriers. Hence, more users will be encouraged to spend money and repeat purchases.

To enable this feature for users to make payments in Mini Programs created inside WeChat, merchants need to integrate with the WeChat Mini Program payment Application Programming Interface (API). Once done, WeChat users access the merchant’s Mini Program and make purchases by entering their payment password to complete the payment.

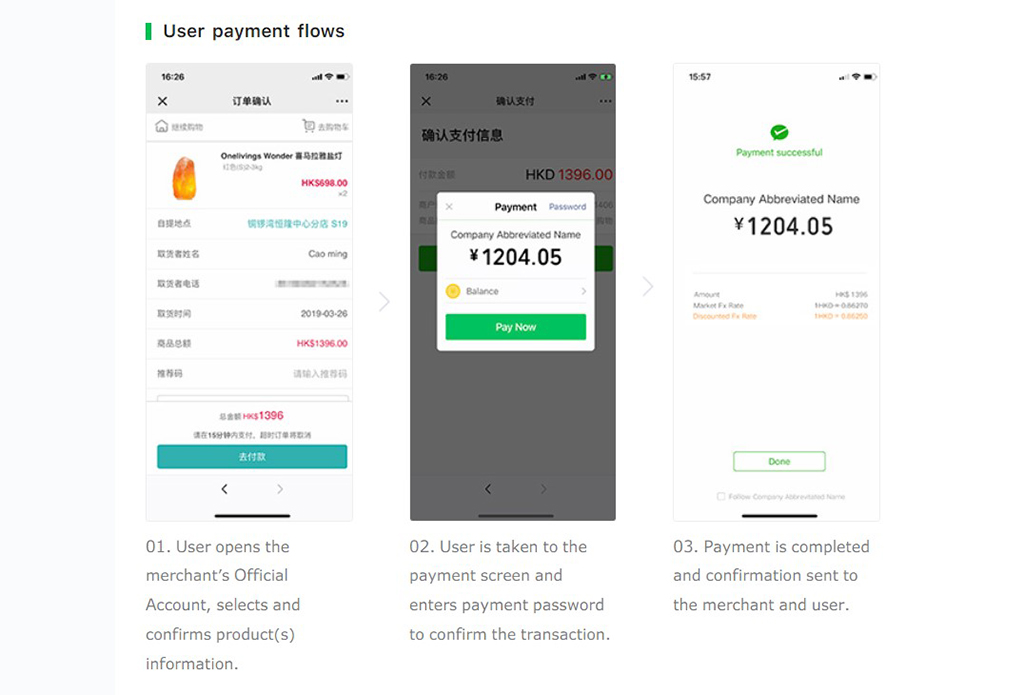

Official Account Payment

WeChat Official Accounts are typically for organizations, governments, media, and celebrities. Aside from facilitating payments inside the Official Account, it also serves as a platform to interact with users on WeChat. Promotions and marketing are among the many benefits that WeChat Official Accounts offer.

Merchants require a WeChat official account before applying for the WeChat Pay service. The merchant must set up the Official Account before consumers pay for anything.

In-App Payment

It makes sense for merchants with existing apps to integrate WeChat Pay into their apps. After all, your goal is to afford an excellent customer buying experience and make it easy for your customers to make payments.

Upon successful integration, WeChat users can easily make payments via WeChat Pay in the merchant's app. The merchant will need to integrate WeChat Pay’s Software Development Kit (SDK) into the app.

Web Payment

Web Payment is a feature to allow users to scan a unique QR code on the website to make a payment. Order details are in a unique QR code on the web page. You launch WeChat and scan this code. After successful verification, the payment completes.

Web Payment is for merchants with web stores that target Chinese consumers. Merchants gain access to this feature upon signing up with WeChat Pay.

Customs Clearance

By activating the Auto Clearance feature, merchants submit customs information on the WeChat Pay Merchant platform. All payment information for the relevant goods is submitted to customs via an API. Hence, customs clearance will be significantly faster.

To do so, you sign up for this feature, enter the necessary customs information in the WeChat Pay Merchant Platform and perform coding following the WeChat Customs Clearance APIs documentation.

Is WeChat Pay Safe to Use?

WeChat Pay functions similarly to other QR-based mobile payment services. Overall, it is safe to use, and the system is reliable and user-friendly. Tencent claims to have invested a lot of effort into building state-of-the-art fraud control and security systems. They claim that each transaction stage is secured in real time.

Also, WeChat complies with the Payment Card Industry Data Security Standard (PCI-DSS), a set of security standards ensuring companies accept, process, store, and transmit credit card information in a secure environment.

Implementing real-time security monitoring helps detect any suspicious behaviors and blocks them in real-time before a disaster happens. However, if anything happens, the account protection Standard Operating Procedures (SOPs) will activate to safeguard the account.

There are other security features. A payment PIN request for each transaction via Quick Pay is one of them. The consumer needs to enter a six-digit payment PIN before confirming the transaction. You, as the user, have the flexibility to remove this. Also, each user's QR code is unique, valid for one transaction only, and time-limited.

There is a maximum daily payment amount via Quick Pay. However, if you lose your phone, someone else can access your account and make unauthorized payments. Hence, you must immediately log in to your WeChat account and freeze your account. Don’t worry. Your account still remains, and freezing is temporary.

Final Thoughts – Is Wechat Pay For You?

WeChat Pay is a payment option available on WeChat. Like other digital wallets, it allows easy and fast cashless payment for in-app purchases, bills, transferring money, and more. Overall, it's a reliable, safe, and convenient way to make payments, especially for WeChat app users.

Whether you are a merchant or a consumer, it makes sense to leverage the WeChat ecosystem. After all, WeChat sports 1.3 billion users as of 2022.

The only question that really needs addressing is whether the WeChat ecosystem is sufficiently mature in your primary location for it to be useful.

Also Read;